But first … I’m having office hours on Valentines day at 10am PT. Grab a cuppa Joe and come join me to talk about making philanthropy more accessible. Zoom link here.

And I’m also making the entire Funder Follies archive available to free subscribers. I want you to read. (And for those who pay or gift a subscription, I’m soooo grateful. Otherwise, enjoy!) On with the show.

I keep thinking about the Chronicle of Philanthropy’s excellent webinar on Key Nonprofit Trends to Watch in 2024. One trend the panelists discussed was foundation payout rates. As you may know, foundations are required by the IRS to grant 5% of assets each year.

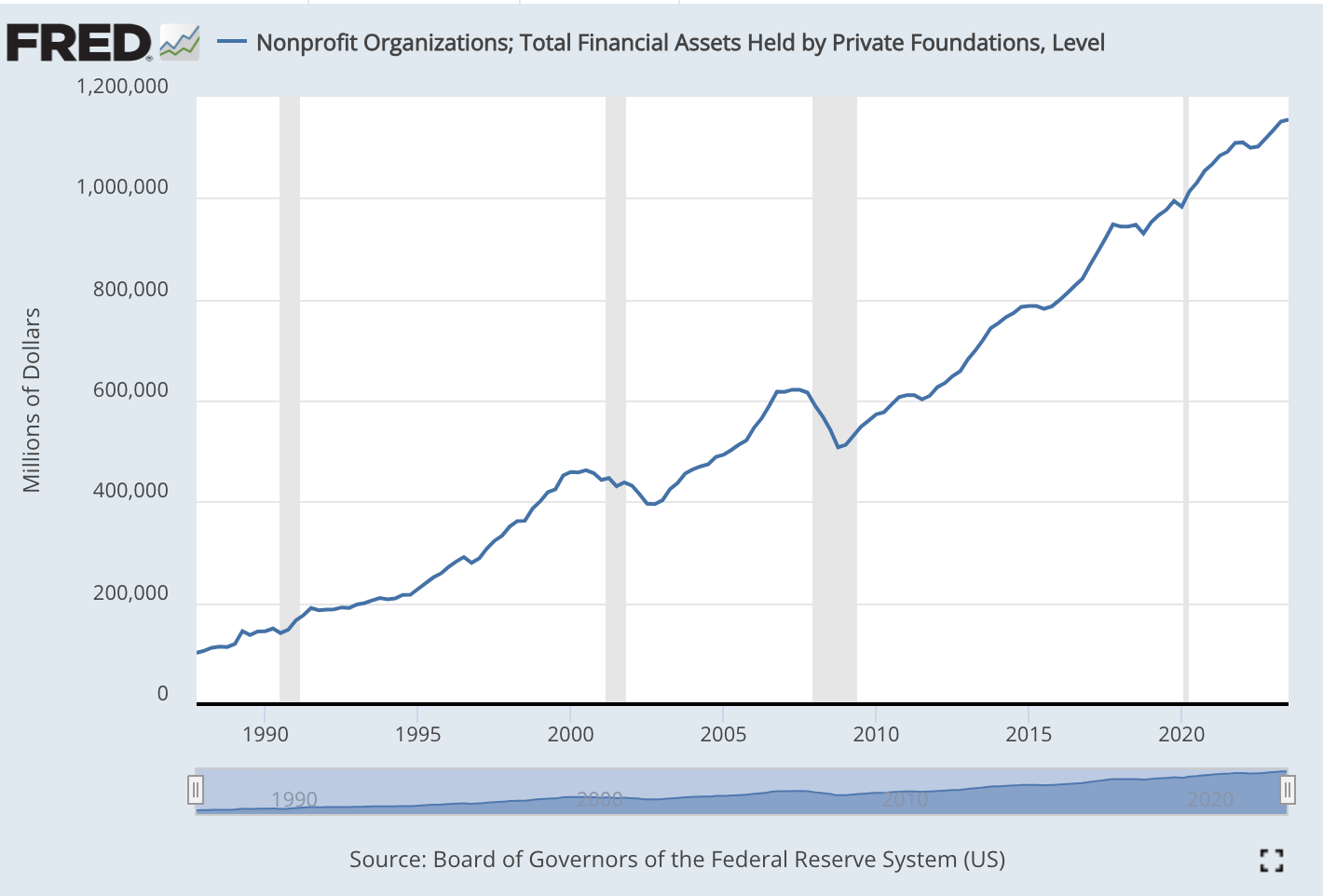

Given the nearly $1.2 trillion owned by foundations, there is much discussion about the enormous amount of wealth that is not being directed into the charity sector.

5% of $1,155,252,000,000

One point two trillion dollars in 2023 means at least $58B in grants made to nonprofits. But it also means $1.097B that just sits in foundations, growing.

Pacific Foundation Services explains the 5% rule. PFS provides philanthropic strategy, operational management, and grantmaking support to private foundations. I’ve had the pleasure of working with a number of their staff over the years.

The 5% figure was agreed upon to ensure that private foundations would, in theory, be able to exist in perpetuity whilst also ensuring that communities and society benefit. The calculation was based on historic market returns of approximately 8% which, after accounting for 3% average historic inflation, leaves 5%. … The total assets calculation is based on a thirteen-month average, not simply the value of the endowment at the end of the fiscal year.

So here’s how that looks for the top 10 private foundations based on 2022 assets.

If you’re wondering about payouts less than 5% on that chart, PFS goes on to explain that…

… it is extremely difficult to hit 5% exactly, and the reason is simple: the payout stems from the 13-month average of asset values, and the value for the final month of the year won’t be known until early in the following year. [Any] underpayment …would be carried over.

And the Winners Are …

Honor to Gates and Bloomberg for paying out well over 5%. Admittedly, the market was down nearly 20% in 2022, so the most recent year may not be the best illustration.

The average S&P annual return between 1957 (Year 1 of the index) and 2023 is 10.26%. So it would seem that 8 of the 10 largest foundations seem to prioritize their own wealth-building over their grantmaking to ensure that “that communities and society benefit.” That math just doesn’t add up.

But there’s an easy solution. Foundations can grant larger percentages of assets. Or acknowledge that the historic basis for the 5% rule has increased: make it 7.26%.

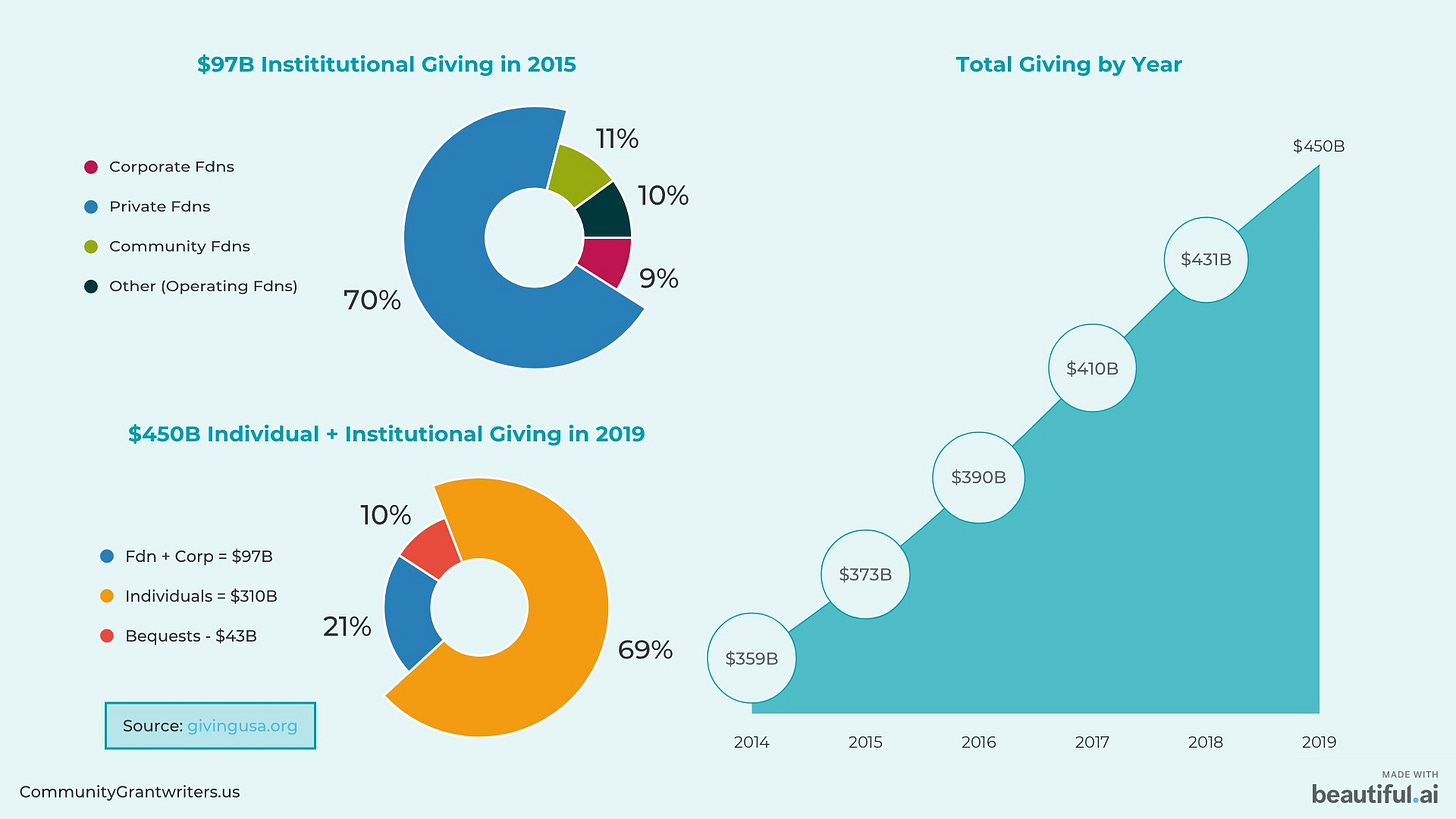

And for all this fuss that I write about each week hoping foundations will make it easier for nonprofits to get grants, so much more money is given by people, not institutions.

Now there’s an idea, grant funding to help grant-dependent nonprofits diversify revenue from individuals.